Inflation for Me & You!

Posted on |

Every news channel worldwide is screaming about Inflation and the rising cost of living. Inflation is hovering above 8% in some countries, a level we haven’t seen in the last 40 years. Inflation is rising around the world & is expected to continue growing through 2022, so you may feel your budget is tight. All countries expect rising Inflation, so nearly everything you buy is becoming more expensive than a year ago. The story is the same for most of every nation, no matter where you live.

There has always been Inflation since money was invented. Inflation has occurred and coexisted with prosperity at times. So we know that Inflation goes hand in hand, It’s not a new word. However, in the past few decades, Inflation has been low in most prosperous economies, and that’s why it hasn’t been a media news front-page story.

Inflation is currently at its highest level in 40 years around the globe. There are several factors responsible for the high inflation number.

Let us look at what is causing this Inflation and how to deal with it.

Pandemic

We are likely to blame the recent rising inflation rate on the pandemic’s effects. The economy has been unable to function normally.

Stimulus package

This is because of the stimulus packages injected into the economy. According to experts, the government put too much money into circulation, resulting devalued the dollar losing its power and inflating prices.

Low cash rate

With low-interest rates, people could afford to make mortgage payments, which pushed up housing prices even further, while businesses expanded and competed for the same limited supply of products.

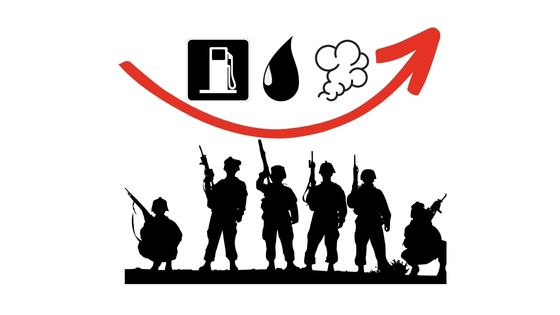

Climbing oil prices/ Russia’s war on Ukraine

Even before the pandemic, energy prices were high because of rising oil prices, which translated to rising gas prices, which eventually caused cost pressure that affected a wide range of industries.

Russian oil is the world’s third-largest oil producer after the USA and Saudi Arabia. It is the world’s second-largest exporter of crude oil to the global market after Saudi Arabia. Energy and gas prices have been on a downward trend,

but experts believe that Russia’s war on Ukraine the situation has made things worse.

So these are a few reasons leading to the highest inflation level. What’s so ever? What does it mean to you and me? Will we get poorer? No, you don’t. Certainly, Inflation does not makes you poor.

Don’t worry. Inflation is harmless. Inflation is not a problem. Inflation is good:-

Your wages rise

Inflation occurs when everything increases in price, including your wages and salaries, which means your paycheck increases. So even if a packet of bread costs doubles and your salary doubles, you can still purchase the same number of bread, which is what happens with Inflation.

Inflation shouldn’t worry you even if you are retired and living off your investment

Inflation doesn’t affect retired people significantly. The price of your investment assets such as houses & Investment property, stocks, and pension funds also rise along with the inflation rate, so your wealth shouldn’t change much; you will still be well off.

The rising inflation rate is good news for borrowers

Furthermore, Inflation helps you if you are a borrower. If you borrowed $400,000 ten years ago for your dream house and it’s now worth $700,000, you own the home for its total value. However, the bank only expects their 400K back from you. So you are benefiting from Inflation.

Consequently, Inflation benefits borrowers, neutral for investors, and only harms people who are holding cash and rely on an income source that doesn’t keep pace with the inflation rate.

- Furthermore, It is suitable for the economy because it encourages people to spend and invest now when prices are expected to rise slightly. With the expectation of price increase, people are more likely to spend and invest now. If prices are stable or falling, we are incentivised to wait to buy for a good deal, the best price.

- If Inflation does not happen, then Deflation will. A country like Japan has been experiencing chronic economic problems for over 20 years as a result of Deflation.

- You and I will continue to prosper in the coming years. During this time of fluctuating prices, the words economy will adjust accordingly, and you and I will survive and flourish. Don’t Panic is the one basic rule that applies to this situation.

- Things are returning to normal slowly and steadily. Businesses are making new investments and increasing production. All developed countries are looking for additional workers globally. The need for skilled workers around the world is increasing. Countries like Australia, Canada, The UK, and Germany are hiring talent worldwide due to labour shortages in their countries to fill their workforce needs. Now is the perfect time to develop your skills and enter the demanding workforce market.

Let’s deal with it! While things slowly sort out, You can take a step forward and immediately make a few changes in your personal finance.

- Your lifestyle has not changed:- Change your mindset towards increasing prices; you should not get caught up in the increasing cost of bananas by a few cents. In reality, 89 cents today may be the same as 79 cents the last year. The currency value has decreased slightly, and The total price has not risen; the currency is simply declining in value. The important thing is how much it costs to maintain your lifestyle as a fraction of your net income.

- Make sure your salary is increasing to keep up with Inflation. In addition to your salary increase with Inflation, your pay should rise much faster if your skills grow. If this does not happen, negotiate a raise with your current employer and, along the side, look for new opportunities with better employers.

- Substituting things- switching to alternative items that are more cost-effective. For example, make something else for dinner if the stake is getting too expensive., which is one of the ways to deal with your rate of Inflation.

- Take advantage of cashback and deal sites like SAVEX Corp

- Find ways to reduce your expenses – The easiest way to reduce your costs is to look at all your bills. You might be able to cut what you don’t need to offset some of the increase in your expenses. Some of the everyday bills that can be cut and reduced are Recurring subscriptions, Gas bills, Internet and phone bill, and Insurance premiums. Looks for deals and offers and Negotiates with energy and gas company providers.

- Invest wisely; continue investing – When you see increasing interest rates and ballooning Inflation, it may make you question your investing plan. However, diversifying your investment is an excellent way to keep up with Inflation.